Difference between revisions of "Todd Lesser"

(Moved US Supreme Court to own section under Federal Case Records) |

|||

| (26 intermediate revisions by one other user not shown) | |||

| Line 6: | Line 6: | ||

* Updated 12 July, 2022 - Includes information on a default judgement in [[#West Virginia | West Virginia]] | * Updated 12 July, 2022 - Includes information on a default judgement in [[#West Virginia | West Virginia]] | ||

* Updated 11 June, 2023 - Includes information on [[#March 2023 Update |ex parte communications to Administrative Judge Kline in AT&T California v. Vaya Telecom case]] | * Updated 11 June, 2023 - Includes information on [[#March 2023 Update |ex parte communications to Administrative Judge Kline in AT&T California v. Vaya Telecom case]] | ||

| − | * Updated 17 June, 2023 - Includes additional court case information | + | * Updated 17 June, 2023 - Includes additional court case information for the [[#United States Supreme Court | United States Supreme Court]], [[#New York | United States District Court Northern District of New York]], [[#Federal Case Records | United States District Court for the District of Oregon]], and the [[#New York | Supreme Court of New York, New York County]] |

| + | * Updated 4 May, 2024 - Added additional [[#Additional_Judgements | judgements]]/[[#Additional_Liens |liens]] and [[#Sale_of_Property | sale of house]] | ||

= Preamble = | = Preamble = | ||

This information listed here is sourced exclusively from public records at the City, State, and Federal levels. All the information contained herein is factual based upon the information obtained via these public records sources. This information is provided '''''as is''''' from the source documents that are linked in this article. | This information listed here is sourced exclusively from public records at the City, State, and Federal levels. All the information contained herein is factual based upon the information obtained via these public records sources. This information is provided '''''as is''''' from the source documents that are linked in this article. | ||

= Background = | = Background = | ||

| − | The majority of recent [[AllStarLink,_Inc.|AllStarLink, Inc.]] ("ASL")<ref>[[AllStarLink,_Inc.|AllStarLink, Inc.]]</ref> issues can be traced back to a time when '''Todd Lesser (KM6RPT)''' ("Todd") became a member of the Board of Directors. This was right after '''Tim Sawyer (WD6AWP)''' ("Tim") left, and '''Bryan Fields (W9CR)''' ("I"/"me") wanted to leave. However, I could not resign as that would leave two people as members of the Board of Directors and caused ASL to be in violation of Florida Statute (FS) 617<ref>http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0600-0699/0617/0617.html</ref>. Todd then joined and I left shortly afterwards. After he assumed the board position, I was surprised at his lack of candor as he immediately began to hold information secret. Shocking as well was the return of Tim Sawyer as a board member. After Tim's resignation due to an unrelated issue which left the board with three members including myself, no argument could be made to have him return. | + | The majority of recent [[AllStarLink,_Inc.|AllStarLink, Inc.]] ("ASL")<ref>[[AllStarLink,_Inc.|AllStarLink, Inc.]]</ref> issues can be traced back to a time when '''Todd Lesser (KM6RPT)'''<ref>https://www.qrz.com/db/KM6RPT</ref> ("Todd") became a member of the Board of Directors. This was right after '''Tim Sawyer (WD6AWP)'''<ref>https://www.qrz.com/db/WD6AWP</ref> ("Tim") left, and '''Bryan Fields (W9CR)'''<ref>https://www.qrz.com/db/W9CR</ref> ("I"/"me") wanted to leave. However, I could not resign as that would leave two people as members of the Board of Directors and caused ASL to be in violation of Florida Statute (FS) 617<ref>http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0600-0699/0617/0617.html</ref>. Todd then joined and I left shortly afterwards. After he assumed the board position, I was surprised at his lack of candor as he immediately began to hold information secret. Shocking as well was the return of Tim Sawyer as a board member. After Tim's resignation due to an unrelated issue which left the board with three members including myself, no argument could be made to have him return. |

| − | My view of this is it was orchestrated to remove me from the board and give Todd a means to exploit ASL. Keep in mind we (ASL) hadn't really known Todd prior to this. I was impressed he finally went out and got his tech license after Jim Dixon ( | + | My view of this is it was orchestrated to remove me from the board and give Todd a means to exploit ASL. Keep in mind we (ASL) hadn't really known Todd prior to this. I was impressed he finally went out and got his tech license after '''Jim Dixon (WB6NIL)(SK)''' ("Jim") passed, but other than him owning a Competitive Local Exchange Carrier (CLEC)<ref>https://en.wikipedia.org/wiki/Competitive_local_exchange_carrier</ref> ("North County Communications Corporation" or "NCC")<ref>https://businesssearch.sos.ca.gov/CBS/SearchResults?filing=&SearchType=CORP&SearchCriteria=NORTH+COUNTY+COMMUNICATIONS+CORPORATION&SearchSubType=Keyword</ref> no one really knew much about him. As a CLEC owner I thought he'd have a working knowledge of Asterisk and general telecom, but I had to show him how to SSH and configure the WB6NIL repeater ([https://stats.allstarlink.org/stats/2024 Node 2024])<ref>[https://stats.allstarlink.org/stats/2024 Node 2024]</ref> at his office to change it to his callsign. |

| − | After Todd became a member of the board, the board itself became very insular and refused to communicate with the ASL Admin Committee <ref>https://wiki.allstarlink.org/index.php?title=Admin_Committee&oldid=4748</ref>. This not only significantly impacted operations but also development and the morale the Admin Committee members in general. Later, '''Pete Elke (WI6H)''' ("Pete") and '''David Shaw (WB6WTM)''' ("David") joined the ASL Board of Directors. This resulted in the ASL Board of Directors becoming even more insular and secretive and I believe this was due, in no small part, to Todd's influence and leadership. | + | After Todd became a member of the board, the board itself became very insular and refused to communicate with the ASL Admin Committee <ref>https://wiki.allstarlink.org/index.php?title=Admin_Committee&oldid=4748</ref>. This not only significantly impacted operations but also development and the morale the Admin Committee members in general. Later, '''Pete Elke (WI6H)'''<ref>https://www.qrz.com/db/WI6H</ref> ("Pete") and '''David Shaw (WB6WTM)'''<ref>https://www.qrz.com/db/WB6WTM</ref> ("David") joined the ASL Board of Directors. This resulted in the ASL Board of Directors becoming even more insular and secretive and I believe this was due, in no small part, to Todd's influence and leadership. |

When we as a board negotiated to get assignment of the assets from Jim's estate, Todd had a serious concern regarding the other non-app_rpt/asterisk assets on Jim such as the MIPL software and its associated marks. Due to ASL not having any Bylaws other than the Admin Charter, any asset that ASL was in possession of or came into the possession of could be sold or transferred to anyone, as there were no protections against it nor was any asset held in trust or protected from normal sale or transfer. This means that any assets or intellectual property ("IP") transferred to ASL could be disposed in any means by a simple majority vote of the board. | When we as a board negotiated to get assignment of the assets from Jim's estate, Todd had a serious concern regarding the other non-app_rpt/asterisk assets on Jim such as the MIPL software and its associated marks. Due to ASL not having any Bylaws other than the Admin Charter, any asset that ASL was in possession of or came into the possession of could be sold or transferred to anyone, as there were no protections against it nor was any asset held in trust or protected from normal sale or transfer. This means that any assets or intellectual property ("IP") transferred to ASL could be disposed in any means by a simple majority vote of the board. | ||

| Line 22: | Line 23: | ||

Any ASL asset could be sold off to a third party far below market value, or transferred. A member of the ASL Board of Directors could have a significant interest or business relationship with this entity, and after the sale/transfer they promptly resign. This third party and former ASL board member would now own the asset/IP that was transferred to it and could sell it for a profit, re-license it (even back to ASL itself), or do other means of monetization. This is basically what happened with the Public Internet Registry ("PIR") which was owned by the Internet Society<ref>https://en.wikipedia.org/wiki/Internet_Society#Sale_of_the_Public_Interest_Registry</ref>. | Any ASL asset could be sold off to a third party far below market value, or transferred. A member of the ASL Board of Directors could have a significant interest or business relationship with this entity, and after the sale/transfer they promptly resign. This third party and former ASL board member would now own the asset/IP that was transferred to it and could sell it for a profit, re-license it (even back to ASL itself), or do other means of monetization. This is basically what happened with the Public Internet Registry ("PIR") which was owned by the Internet Society<ref>https://en.wikipedia.org/wiki/Internet_Society#Sale_of_the_Public_Interest_Registry</ref>. | ||

| − | Such actions would be a major conflict of interest and was the reason Jim transferred control of AllStarLink to Steve Zingman (N4IRS) ("Steve") who was part of the initial incorporation of AllStarLink, Inc. in an effort to preserve the AllStarLink Network, assets, and ensure its continued operation. | + | Such actions would be a major conflict of interest and was the reason Jim transferred control of AllStarLink to '''Steve Zingman (N4IRS)'''<ref>https://www.qrz.com/db/N4IRS</ref> ("Steve") who was part of the initial incorporation of AllStarLink, Inc. in an effort to preserve the AllStarLink Network, assets, and ensure its continued operation. |

I was always wondering why Todd was "''chomping at the bit''" when it came to ASL assets, and this finally started to make sense in late 2020: | I was always wondering why Todd was "''chomping at the bit''" when it came to ASL assets, and this finally started to make sense in late 2020: | ||

| Line 84: | Line 85: | ||

On March 5th, 2014 the United States District Court for the District of Oregon, as part of the legal proceedings regarding NCC's use of MF Signaling, and the Interconnection Agreement with Qwest, issued an Opinion and Order on case 3:13-CV-00375-BR<ref>[[media:US District Court - District of Oregon Case 3-13-cv-00375-BR Opinion and Order.pdf|US District Court - District of Oregon Case 3-13-cv-00375-BR-Opinion and Order - North County Communications Corporation of Oregon vs Qwest Corporation, Susan Akerman, John Savage, Stephen Bloom, all in their capacity as Commissioners of the Public Utility Commission of Oregon]]</ref> in which NCC's motion for Summary Judgement against Qwest Corporation and The Oregon Public Utilities Commission was denied and NCC's claim was dismissed with prejudice. The judge instead ruled in favor of both Qwest and the Oregon PUC. | On March 5th, 2014 the United States District Court for the District of Oregon, as part of the legal proceedings regarding NCC's use of MF Signaling, and the Interconnection Agreement with Qwest, issued an Opinion and Order on case 3:13-CV-00375-BR<ref>[[media:US District Court - District of Oregon Case 3-13-cv-00375-BR Opinion and Order.pdf|US District Court - District of Oregon Case 3-13-cv-00375-BR-Opinion and Order - North County Communications Corporation of Oregon vs Qwest Corporation, Susan Akerman, John Savage, Stephen Bloom, all in their capacity as Commissioners of the Public Utility Commission of Oregon]]</ref> in which NCC's motion for Summary Judgement against Qwest Corporation and The Oregon Public Utilities Commission was denied and NCC's claim was dismissed with prejudice. The judge instead ruled in favor of both Qwest and the Oregon PUC. | ||

| − | '''Case background:''' In 1997, NCC and Qwest entered into an Interconnection Agreement (ICA), which defined how both parties would connect to each other and conduct business. The ICA was submitted to and approved by multiple State Public Utilities Commissions as the binding document for NCC and Qwest to conduct business in each PUC's jurisdiction. NCC and Qwest amended the 1997 ICA several times between September 1997 and April 2011. In July 2008 NCC received a request for negotiation from Qwest regarding a new ICA pursuant to the 47 U.S.C. § 252(a)<ref>[https://www.law.cornell.edu/uscode/text/47/252 47 U.S. Code § 252 - Procedures for negotiation, arbitration, and approval of agreements]</ref> - Part of the Telecommunications Act of | + | '''Case background:''' In 1997, NCC and Qwest entered into an Interconnection Agreement (ICA), which defined how both parties would connect to each other and conduct business. The ICA was submitted to and approved by multiple State Public Utilities Commissions as the binding document for NCC and Qwest to conduct business in each PUC's jurisdiction. NCC and Qwest amended the 1997 ICA several times between September 1997 and April 2011. In July 2008 NCC received a request for negotiation from Qwest regarding a new ICA pursuant to the 47 U.S.C. § 252(a)<ref>[https://www.law.cornell.edu/uscode/text/47/252 47 U.S. Code § 252 - Procedures for negotiation, arbitration, and approval of agreements]</ref> - Part of the Telecommunications Act of 1996. Qwest sought a new ICA because the 1997 ICA was outdated due to "''technological changes in Qwest's processes and products and NCC's use of multifrequency (MF) (analog) signaling was archaic''". Even though Qwest was willing to accommodate MF signaling for traffic terminating to NCC, Qwest requested the new ICA to include a provision that NCC must use a newer technology called SS7 (digital) signaling if it wished to begin terminating traffic with or through Qwest. NCC contended that Qwest's proposed ICA would force NCC to get rid of its existing network in favor of an "''unnecessary technological update and an untested agreement''". NCC also asserted Qwest was not legally permitted to dictate NCC's technology choices and did not have a valid justification for changing the terms of the then-existing 1997 ICA. One item of particular interest in this is that this case went to arbitration, the Arbitrator's decisions were accepted by the various PUCs as binding regarding the new ICA, and NCC challenged this in court in each of the respective PUCs jurisdictions (in this case Arizona and Oregon) and lost both challenges. NCC contended that Qwest was not allowed to initiate the renegotiation of the ICA under 47 U.S.C. § 252(a)(1), as Qwest was an ILEC, stating that the law only allowed CLECs to initiate the negotiations for ICAs with ILECs. |

<blockquote> | <blockquote> | ||

Section 252 (a)(1) provides: Upon receiving a request for interconnection, services, or network elements pursuant to section 251 [47 U.S.C. § 251], an incumbent local exchange carrier may | Section 252 (a)(1) provides: Upon receiving a request for interconnection, services, or network elements pursuant to section 251 [47 U.S.C. § 251], an incumbent local exchange carrier may | ||

| Line 96: | Line 97: | ||

</blockquote> | </blockquote> | ||

| − | The court ruled that it agreed with the NCC Arizona | + | The court ruled that it agreed with the district court in ''NCC Arizona'' that § 252(a)(1) does not prohibit an ILEC from requesting interconnection with a CLEC (meaning that Qwest was allowed to initiate the renegotiation of the 1997 ICA with NCC). The Court concludes, therefore, that Qwest was permitted to request arbitration and the Commission had the authority to arbitrate the parties’ 2011 ICA. Accordingly, the Court declines NCC's motion to declare the 2011 ICA ''void ab initio'' (void from the beginning). |

|- | |- | ||

| [https://www.youtube.com/watch?v=uycO9mx9VTo 15-56678 North County Communications v. Sprint Communications Co.] | | [https://www.youtube.com/watch?v=uycO9mx9VTo 15-56678 North County Communications v. Sprint Communications Co.] | ||

| Line 165: | Line 166: | ||

! Information/Description | ! Information/Description | ||

|- | |- | ||

| − | | [[media:Search - Supreme Court of the United States - Docket 10-257.pdf|Supreme Court of the United States - No 10-257 - North County Communications | + | | [[media:Search - Supreme Court of the United States - Docket 10-257.pdf|Supreme Court of the United States - No 10-257 - North County Communications Corp vs California Catalog and Technology dba CTT Telecomms, Petition for Write of Certiorari. Petition was DENIED.]]<ref>https://www.supremecourt.gov/search.aspx?filename=/docketfiles/10-257.htm</ref> |

| − | | Petition regarding Case No 08-55048 from the United States Court of Appeals for the Ninth Circuit. | + | | Petition regarding Case No 08-55048 from the United States Court of Appeals for the Ninth Circuit. '''''Writs of Certiorari'''''<ref>https://www.law.cornell.edu/wex/writ_of_certiorari</ref>: Parties who are not satisfied with the decision of a lower court must petition the U.S. Supreme Court to hear their case.<ref>https://www.uscourts.gov/about-federal-courts/educational-resources/about-educational-outreach/activity-resources/supreme-1</ref> |

|- | |- | ||

|} | |} | ||

</center> | </center> | ||

| + | |||

= Bankruptcy Court = | = Bankruptcy Court = | ||

| Line 249: | Line 251: | ||

|} | |} | ||

</center> | </center> | ||

| + | |||

| + | == Additional Liens == | ||

| + | The following gives more information on Liens that were found: | ||

| + | <center> | ||

| + | {| class="wikitable" style="text-align: left; width: 85%" | ||

| + | |+ Liens | ||

| + | ! Name | ||

| + | ! Address | ||

| + | ! Filing Location | ||

| + | ! Total Lien Amount | ||

| + | ! Issuing Agency | ||

| + | ! Deed Category Type | ||

| + | ! Damar Document Type | ||

| + | ! Document Recording Number | ||

| + | ! Court Case Number | ||

| + | ! Tax Lien Serial Number | ||

| + | ! Tax Type | ||

| + | ! Tax Payer ID | ||

| + | ! Tax Period Dates | ||

| + | ! Tax Lien Date | ||

| + | ! Recording Date | ||

| + | |- | ||

| + | | Todd Lesser | ||

| + | | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | ||

| + | | San Diego, CA | ||

| + | | $9,410.74 | ||

| + | | FRANCHISE TAX BOARD | ||

| + | | Placement | ||

| + | | State Tax Lien | ||

| + | | 217277 | ||

| + | | 217227 | ||

| + | | 23222602917 | ||

| + | | FRANCHISE TAX | ||

| + | | 120613256 | ||

| + | | Dec 31, 2017 - Dec 31, 2019 | ||

| + | | Aug 10, 2023 | ||

| + | | Aug 10, 2023 | ||

| + | |} | ||

| + | </center> | ||

| + | |||

| + | == Additional Judgements == | ||

| + | The following gives a more comprehensive listing of Judgements that were found: | ||

| + | <center> | ||

| + | {| class="wikitable" style="text-align: left; width: 85%" | ||

| + | |+ Judgements | ||

| + | ! Debtor Name | ||

| + | ! Address | ||

| + | ! Creditor Name | ||

| + | ! Filing Location | ||

| + | ! Court Case Number | ||

| + | ! Total Judgement Amount | ||

| + | ! Deed Category Type | ||

| + | ! Damar Document Type | ||

| + | ! Recording Number | ||

| + | ! Recording Date | ||

| + | ! Abstract Issue Date | ||

| + | |- | ||

| + | | TODD LESSER | ||

| + | | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | ||

| + | | PAMELA A PHILLIPS | ||

| + | | San Diego, CA | ||

| + | | 372****83845CUBCCT | ||

| + | | $1,788,279.14 | ||

| + | | Placement | ||

| + | | Abstract of Judgment Modification | ||

| + | | 357138 | ||

| + | | Sep 8, 2022 | ||

| + | | Sep 7, 2022 | ||

| + | |- | ||

| + | | TODD LESSER | ||

| + | | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | ||

| + | | - | ||

| + | | Riverside, CA | ||

| + | | 37-2011****5-CU-B | ||

| + | | $504,507.93 | ||

| + | | Placement | ||

| + | | Judgement | ||

| + | | 141583 | ||

| + | | Apr 25, 2019 | ||

| + | | Apr 4, 2019 | ||

| + | |- | ||

| + | | TODD LESSER | ||

| + | | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | ||

| + | | CITY OF SAN DIEGO | ||

| + | | San Diego, CA | ||

| + | | 37-2015****71-CU- | ||

| + | | $200,000.00 | ||

| + | | Placement | ||

| + | | Judgement | ||

| + | | 126301 | ||

| + | | Mar 29, 2018 | ||

| + | | Mar 23, 2018 | ||

| + | |- | ||

| + | | TODD LESSER | ||

| + | | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | ||

| + | | BANK OF AMERICA NA | ||

| + | | San Diego, CA | ||

| + | | 37-2016****42 | ||

| + | | $136,727.96 | ||

| + | | Placement | ||

| + | | Judgement | ||

| + | | 444025 | ||

| + | | Sep 27, 2017 | ||

| + | | Jul 17, 2017 | ||

| + | |- | ||

| + | | TODD LESSER | ||

| + | | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | ||

| + | | DISCOVER BANK | ||

| + | | San Diego, CA | ||

| + | | 37-2016****67-CL- | ||

| + | | $6,088.86 | ||

| + | | Placement | ||

| + | | Judgement | ||

| + | | 441050 | ||

| + | | Sep 26, 2017 | ||

| + | | Aug 15, 2017 | ||

| + | |} | ||

| + | </center> | ||

| + | |||

| + | = Sale of Property = | ||

| + | On 15 April 2024, Todd Lesser's long time primary residence of 2717 Hidden Valley Rd, La Jolla, CA (SDMLS #230018679) was sold for $2,650,000. The properly was listed on 22 Sept 2023 for the amount of $2,995,000 as 2,528 Sq Ft with 4 bedrooms and 2 bathrooms. | ||

= Uniform Commercial Code (UCC) Filings = | = Uniform Commercial Code (UCC) Filings = | ||

| Line 581: | Line 704: | ||

* Prior to successfully serving the Complaint upon the Defendant's spouse, the Defendant and/or spouse evaded my attempts at service on multiple occasions. | * Prior to successfully serving the Complaint upon the Defendant's spouse, the Defendant and/or spouse evaded my attempts at service on multiple occasions. | ||

| + | |||

| + | = New York = | ||

| + | Our search in New York produced the following. | ||

| + | |||

| + | In 2002, NCC filed suit against Verizon New York (VNY), Verizon Services Corporation (Verizon), and what is listed as DOES 1 through 100. The suit was originally brought by NCC in New York State court. Verizon filed a notice to remove the action to federal district court, and NCC moved to remand it back to state court. The following are excepts from United States District Court, Northern District New York Case 1:02-cv-01065-DNH-RFT, MEMORANDUM-DECISION and ORDER<ref>[[media:Case 1-02-cv-01065-DNH-RFT - Doc 24 - Order.pdf|North County Communications v Verizon New York Inc; Verizon Services Corporation; and DOES 1 through 100]]</ref> regarding the case and both parties actions. | ||

| + | |||

| + | NCC alleged in their complaint: | ||

| + | * On March 14, 2001, NCC as a CLEC, notified Verizon of its intent to interconnect with Verizon networks in New York State. VNY is an ILEC. NCC claims that in the six months following, Verizon "deliberately dragged [its] feet and put up obstacles and roadblocks to keep [North County] out of the local telecommunications market in New York, all for the purpose of maintaining [VNY's] grip on the local telephone market, depriving consumers maximum choice with their telecommunications dollars and damaging [North County] in the process" | ||

| + | * NCC claimed that the Verizon account manager assigned "stonewall[ed] the interconnection process by making unreasonable, onerous and unnecessary demands upon [North County]". | ||

| + | ** Among the demands made was the alleged interconnection prerequisite that a "dedicated" facility be built. NCC contends that VNY, as in ILEC, controls facilities throughout the New York telecommunications market, stating that he funding necessary to build these facilities was provided in part by VNY's ratepayers and those of it predecessors, New York Telephone and Bell Atlantic. | ||

| + | * NCC was unable to procure funding for the construction of new facilities, and instead requested interconnection at two separate Verizon facilities in New York. NCC claimed that Verizon refused the request, despite the technical capabilities to grant it, and despite allowing other affiliates or parties to share the facilities. Instead Verizon restated the requirements to build new facilities and refused to hold further meetings with NCC until the construction of the new facilities was complete. | ||

| + | * NCC stated that Verizon acted in a way to continue maintaining "monopolistic power over the New York City telecommunications market" including: | ||

| + | ** repeatedly lost orders and signature pages | ||

| + | ** ignored [North County's] request to opt into an exiting interconnections [sic] agreement between [VNY] and another CLEC; as was North County's right | ||

| + | ** insisted on installing equipment on unnecessary additional racks at the location where [North County] was subleasing space, despite the absence of any technical reason to impose such a requirement, and needlessly raising the cost of doing business for [North County] | ||

| + | ** refused to allow [North County] to order interconnection trunks, thus preventing [North County] from being able to order prefixes | ||

| + | ** refused to build trunks in as timely a fashion as with other service offerings, and as if [North County] were a retail customer | ||

| + | ** demanded that [North County] provide the defendants with information which [North County] was unable to provide because the information resided in the defendants' sole possession, and then delayed the interconnection process further when [North County] was unable to provide the information demanded | ||

| + | ** demanded that information which [North County] had already submitted to be resubmitted in a different format | ||

| + | ** failed to treat [North County] as well as if [it] were a [VNY] retail customer or an affiliate of the defendants; and | ||

| + | ** refused to use a shared mux for wholesale services, despite the technical feasibility of doing so | ||

| + | |||

| + | Additionally, NCC claimed that Verizon engaged in anti-competitive and monopolistic activities in violation of the Donnelly Act, N.Y. Gen Bus L § 340<ref>[https://law.justia.com/codes/new-york/2022/gbs/article-22 Donnelly Act, N.Y. Gen Bus L § 340]</ref>. And NCC claimed that Verizon had a duty, under Article 5, Section 91 of the New York Public Service Law, "''to provide and furnish instrumentalities and facilities that were adequate, just and reasonable, and to refrain from making unreasonable or unjust charges for services rendered.''" NCC also claimed that Verizon was making charges and demands that were greater than those made of other similar corporations, and that "Verizon subjected North County unreasonable prejudice or disadvantage". | ||

| + | |||

| + | The District Court ruled that Verizon's motion to move the case from state to federal court was unwarranted under existing case law, and that "''North County's Complaint is Well-Pleaded''" with regards to keeping the case in state jurisdiction. The District Court ruled: | ||

| + | <blockquote> | ||

| + | The plaintiff's well-pleaded complaint alleges only state law claims. Such claims are neither artfully pleaded or completely preempted by federal law. The interconnection agreement itself, if in fact it does control, does not mandate that federal claims be asserted in federal court. No subject matter jurisdiction exists. This case must be remanded to the Supreme Court of New York. Accordingly, it is ORDERED that: 1. Plaintiff North County Communications Corporation's motion to remanded is GRANTED; and 2. The case is remanded back to the Supreme Court of New York, County of Albany." | ||

| + | </blockquote> | ||

| + | |||

| + | The Supreme Court of New York, County of Albany reviewed the case and granted the defendant's motion that it be moved from Albany County to New York County (Manhattan). | ||

| + | |||

| + | The Supreme Court of New York, New York County reviewed the case (401925-03)<ref>[[media:401925-03-001 PDF.pdf|North County Communications Corporation -against- Verizon New York Inc, Verizon Services Corporation, and DOES 1 THROUGH 100. - Index No 401925/03. P.C.No 18455]]</ref>, the court examined the claims from both sides, and ruled that: | ||

| + | * NCC's allegations under the Donnelly Act and Public service Law, both State claims, are independent of any interconnection agreement, and that NCC's complaint is regarding Verizon's conduct. | ||

| + | * NCC's claim under the Donnelly Act: "''the complaint does not allege concerted action in support of a conspiracy, or a reciprocal relationship between two or more entities. Rather, NCC's allegations are directed towards Verizon's alleged unilateral actions and delay tactics. The failure to identify a coconspirator cannot be remedied 'by asserting, in conclusory fashion, the existence of a generalized conspiracy arising our of defendants' various contracts and arrangements or by referring to uniliateral business action taken by them' and NCC's failure 'to allege that the defendant engaged in concerted activity requires dismissal'''". The court also stated that "''sister subsidiary corporations which are wholly owned by the same parent corporation are legally incapable of conspiring with each other''". It was also noted that NCC's failure to state the names of the "''numerous Doe defendants''" led to the dismissal of the Donnelly Act claim for lack of sufficient evidence. | ||

| + | * NCC's Public Service Law claim, mainly that "''sections 91 and 93 of the Public Service law should be interpreted broadly''" was dismissed. | ||

| + | |||

| + | <blockquote> | ||

| + | Accordingly, it is hereby ORDERED that the motion to dismiss is granted and the complaint is dismissed, without prejudice as indicated, with costs and disbursements to defendant as taxed by the Clerk of the Court; and it is further ORDERED that the Clerk is directed to enter judgement accordingly. | ||

| + | </blockquote> | ||

= Local Politics= | = Local Politics= | ||

| Line 622: | Line 784: | ||

|- | |- | ||

| San Diego, La Jolla Shores Association Address Election Challenge | | San Diego, La Jolla Shores Association Address Election Challenge | ||

| − | | https://www.lajollalight.com/sdljl-shores-association-address-election-challenge-2015-2015may21-story.html<ref name="LAJollaLight>https://www.lajollalight.com/sdljl-shores-association-address-election-challenge-2015-2015may21-story.html</ref> | + | | https://www.lajollalight.com/sdljl-shores-association-address-election-challenge-2015-2015may21-story.html<ref name="LAJollaLight>https://web.archive.org/web/20201023120251/https://www.lajollalight.com/sdljl-shores-association-address-election-challenge-2015-2015may21-story.html</ref> |

| Todd argues over flipping a coin. His attorney makes a case that a strict following of Roberts Rules of Order is Required. | | Todd argues over flipping a coin. His attorney makes a case that a strict following of Roberts Rules of Order is Required. | ||

|- | |- | ||

Latest revision as of 18:04, 1 March 2025

- Updated 12 July, 2022 - Includes information on a default judgement in West Virginia

- Updated 11 June, 2023 - Includes information on ex parte communications to Administrative Judge Kline in AT&T California v. Vaya Telecom case

- Updated 17 June, 2023 - Includes additional court case information for the United States Supreme Court, United States District Court Northern District of New York, United States District Court for the District of Oregon, and the Supreme Court of New York, New York County

- Updated 4 May, 2024 - Added additional judgements/liens and sale of house

Preamble

This information listed here is sourced exclusively from public records at the City, State, and Federal levels. All the information contained herein is factual based upon the information obtained via these public records sources. This information is provided as is from the source documents that are linked in this article.

Background

The majority of recent AllStarLink, Inc. ("ASL")[2] issues can be traced back to a time when Todd Lesser (KM6RPT)[3] ("Todd") became a member of the Board of Directors. This was right after Tim Sawyer (WD6AWP)[4] ("Tim") left, and Bryan Fields (W9CR)[5] ("I"/"me") wanted to leave. However, I could not resign as that would leave two people as members of the Board of Directors and caused ASL to be in violation of Florida Statute (FS) 617[6]. Todd then joined and I left shortly afterwards. After he assumed the board position, I was surprised at his lack of candor as he immediately began to hold information secret. Shocking as well was the return of Tim Sawyer as a board member. After Tim's resignation due to an unrelated issue which left the board with three members including myself, no argument could be made to have him return.

My view of this is it was orchestrated to remove me from the board and give Todd a means to exploit ASL. Keep in mind we (ASL) hadn't really known Todd prior to this. I was impressed he finally went out and got his tech license after Jim Dixon (WB6NIL)(SK) ("Jim") passed, but other than him owning a Competitive Local Exchange Carrier (CLEC)[7] ("North County Communications Corporation" or "NCC")[8] no one really knew much about him. As a CLEC owner I thought he'd have a working knowledge of Asterisk and general telecom, but I had to show him how to SSH and configure the WB6NIL repeater (Node 2024)[9] at his office to change it to his callsign.

After Todd became a member of the board, the board itself became very insular and refused to communicate with the ASL Admin Committee [10]. This not only significantly impacted operations but also development and the morale the Admin Committee members in general. Later, Pete Elke (WI6H)[11] ("Pete") and David Shaw (WB6WTM)[12] ("David") joined the ASL Board of Directors. This resulted in the ASL Board of Directors becoming even more insular and secretive and I believe this was due, in no small part, to Todd's influence and leadership.

When we as a board negotiated to get assignment of the assets from Jim's estate, Todd had a serious concern regarding the other non-app_rpt/asterisk assets on Jim such as the MIPL software and its associated marks. Due to ASL not having any Bylaws other than the Admin Charter, any asset that ASL was in possession of or came into the possession of could be sold or transferred to anyone, as there were no protections against it nor was any asset held in trust or protected from normal sale or transfer. This means that any assets or intellectual property ("IP") transferred to ASL could be disposed in any means by a simple majority vote of the board.

For example: Any ASL asset could be sold off to a third party far below market value, or transferred. A member of the ASL Board of Directors could have a significant interest or business relationship with this entity, and after the sale/transfer they promptly resign. This third party and former ASL board member would now own the asset/IP that was transferred to it and could sell it for a profit, re-license it (even back to ASL itself), or do other means of monetization. This is basically what happened with the Public Internet Registry ("PIR") which was owned by the Internet Society[13].

Such actions would be a major conflict of interest and was the reason Jim transferred control of AllStarLink to Steve Zingman (N4IRS)[14] ("Steve") who was part of the initial incorporation of AllStarLink, Inc. in an effort to preserve the AllStarLink Network, assets, and ensure its continued operation.

I was always wondering why Todd was "chomping at the bit" when it came to ASL assets, and this finally started to make sense in late 2020:

Research showed that in September 2020, Todd Lesser had several lawsuits against him with judgements in excess of 2.5 Million Dollars ($2,500,000.00) as well as having property seized in San Diego for conspiring to distribute narcotics. Unfortunately, any initial research done on Todd was hampered by the poor access to public records in California vs. what Florida has under the Sunshine Act[15]. There was also some limited information in the Federal Courts under PACER.[16]

What was clear is that he had filed bankruptcy at least twice in the last 5 years and been involved in litigation against two major telecom carriers in the Federal courts.

Case Summary

It's clear in these cases that NCC engaged in a practice know as "access stimulation" (a.k.a. traffic pumping)[17]. In short NCC is a phone company, and as a phone company it is permitted to bill other phone companies for calls to the CLEC's (its) customers. Typically these rates are in the .01 or .02 cents per minute which is the same for all carriers, and known as a "tariff". This tariff can be much higher in certain areas of the US, as is the case typically were phone service is provided by non-Regional Bell Operating Company (RBOC)[18] Incumbent local exchange carrier (ILEC)[19] phone companies, and can be .02-.04 cents per minute. A CLECs operating in these higher tariff areas by service customers make more money. These areas tend to be rural and not populated, thus being more expensive for the CLEC to provide services in.

CLECs operating in these areas and billing the ILECs in excess of a million minutes per month was not unheard of. As can be imagined, this can net a sizeable profit for the CLECs.

Typically, these calls are only permitted to be charged for customer to customer calls, any automated calls or chat lines (typically sexual in nature) are not subjected to these fees. Additionally, they tend to only be a small part of the inbound calls as most legitimate chat lines use an 800 or 900 number and require a customer to pay via credit card for the call. These chat line operators are also separate businesses from the CLEC.

If the sex chat operator can find a less than honorable CLEC, they can enter into a business agreement where calls to the chat line from a local number are "free" to the caller that "exists" in one of these higher tariff areas. The CLEC in turn uses this "access stimulation" to for several million minutes a month to calls in this high tariff area and then bill the RBOC ILEC instead of the customer at this higher rate. The result is the CLEC collecting several million dollars of "profit" per month from the chat line operator providing the "access stimulation" needed.

In all cases below Todd is the owner of NCC and the sex chat line operator HFT, Inc. ("HFT")[20]. In the filings we can find HFT never paid NCC for access as a typical customer of a CLEC would. Instead HTF existed only to stimulate calls for NCC in these high tariff areas, who in turn billed the ILEC and pocketed the money collected. This is an arrangement which viewed though the best of intentions would be considered fraudulent.

In the Mid 2000's most carriers began auditing to find this sort of operation via call detail records ("CDR")[21] auditing. The use of the Signalling System No 7 ("SS7)[22] interconnect protocol along with modern auditing software sold by the major telecom vendors helped in the cracking down on this fraudulent behavior by CLECs. The use of the SS7 protocol in the US was mandated by the Federal Communications Commission ("FCC") via a rule the passed in 2011 [23].

Under the laws in the mid 2000's most carriers had to sue or petition the FCC for redress. In some cases they refused to pay the fraudulent bills by the CLEC's and the CLEC would sue the big carrier. This is indeed what NCC did, suing Verizon, Metro PCS, T-Mobile, Sprint and Vaya Telecom for failure to pay their interconnection charges. In all cases these resulted in judgements against NCC and Todd Lesser personally.

Federal Records

In PACER We found Todd/NCC sued or counter-sued by Verizon, Sprint, T-Mobile and other carriers for billing irregularities related to access stimulation.

FCC

Before the FCC, Sprint, and T-Mobile 2015-01-23 Joint Statement to FCC regarding discovery Sprint v NCC[24]

Note: FCC/Court rulings list NCC as NCC in some instances.

STATEMENT OF UNDISPUTED FACTS:

- All revenues of NCC and HFT are for the benefit of Mr. Lesser.

- NCC’s traffic from Sprint is “100 percent chat line traffic.”

- In a lawsuit against Vaya Telecom pending in state court in California, Todd Lesser was personally sanctioned $92,966.45 for discovery violations, including violations of court orders to produce financial records involving transactions between NCC and HFT. The discovery referee found he was willfully untruthful under oath during his deposition.

- Mr. Lesser testified in the Sprint matter that he created the invoices on a monthly basis in custom software that he wrote himself

- After NCC produced the invoices, Verizon obtained an order directing NCC to produce all computer drives it used to create, modify, or manipulate those invoices so that a court-appointed expert could test whether the HFT invoices were, as in Farmers II, backdated. The neutral forensic expert appointed by the District Court examined the two drives Mr. Lesser produced – an Apple iBook G-4 laptop hard drive (“Mac Computer”) and a removable USB flash drive (“Thumb Drive”).64 (Compl. ¶ 102; but see Answer ¶ 115)

- Todd Admits to deleting the bash history and log of commands during discovery.

- The District Court sanctioned NCC for evidence destruction

Federal Case Records

| Media | Information/Description |

|---|---|

| 14-15115 North County Communications Co v. Qwest Corporation | NCC's of summary judgements against them from the Arizona Corporations Commission[25] and the Oregon PUC[26]

In both these cases, the local regulatory bodies were called by Todd/NCC as NCC was contesting not being paid for calls to NCC "customers". These Customers of NCC are almost 100% sex chat lines. In this decision by the ACC[27] was a summary judgement in favor of Qwest. This is what is being appealed here. There's some funny things to read in this case, such as NCC insisting to use MF signaling[28] rather than SS7[29], and complaining about the cost for a MX2800 M13 mux. These are the sorts of complaints which seem frivolous to anyone in telecommunications Searching for "North County Communications Corporation" on the ACC search page[30] will produce many documents showing NCC to be on the losing end of the argument. On March 5th, 2014 the United States District Court for the District of Oregon, as part of the legal proceedings regarding NCC's use of MF Signaling, and the Interconnection Agreement with Qwest, issued an Opinion and Order on case 3:13-CV-00375-BR[31] in which NCC's motion for Summary Judgement against Qwest Corporation and The Oregon Public Utilities Commission was denied and NCC's claim was dismissed with prejudice. The judge instead ruled in favor of both Qwest and the Oregon PUC. Case background: In 1997, NCC and Qwest entered into an Interconnection Agreement (ICA), which defined how both parties would connect to each other and conduct business. The ICA was submitted to and approved by multiple State Public Utilities Commissions as the binding document for NCC and Qwest to conduct business in each PUC's jurisdiction. NCC and Qwest amended the 1997 ICA several times between September 1997 and April 2011. In July 2008 NCC received a request for negotiation from Qwest regarding a new ICA pursuant to the 47 U.S.C. § 252(a)[32] - Part of the Telecommunications Act of 1996. Qwest sought a new ICA because the 1997 ICA was outdated due to "technological changes in Qwest's processes and products and NCC's use of multifrequency (MF) (analog) signaling was archaic". Even though Qwest was willing to accommodate MF signaling for traffic terminating to NCC, Qwest requested the new ICA to include a provision that NCC must use a newer technology called SS7 (digital) signaling if it wished to begin terminating traffic with or through Qwest. NCC contended that Qwest's proposed ICA would force NCC to get rid of its existing network in favor of an "unnecessary technological update and an untested agreement". NCC also asserted Qwest was not legally permitted to dictate NCC's technology choices and did not have a valid justification for changing the terms of the then-existing 1997 ICA. One item of particular interest in this is that this case went to arbitration, the Arbitrator's decisions were accepted by the various PUCs as binding regarding the new ICA, and NCC challenged this in court in each of the respective PUCs jurisdictions (in this case Arizona and Oregon) and lost both challenges. NCC contended that Qwest was not allowed to initiate the renegotiation of the ICA under 47 U.S.C. § 252(a)(1), as Qwest was an ILEC, stating that the law only allowed CLECs to initiate the negotiations for ICAs with ILECs.

The court's opinion of NCC's challenge:

The court ruled that it agreed with the district court in NCC Arizona that § 252(a)(1) does not prohibit an ILEC from requesting interconnection with a CLEC (meaning that Qwest was allowed to initiate the renegotiation of the 1997 ICA with NCC). The Court concludes, therefore, that Qwest was permitted to request arbitration and the Commission had the authority to arbitrate the parties’ 2011 ICA. Accordingly, the Court declines NCC's motion to declare the 2011 ICA void ab initio (void from the beginning). |

| 15-56678 North County Communications v. Sprint Communications Co. | NCC's appeal following a week long trial against Sprint Communications. This is worth watching, as NCC has been found to be overcharging sprint for calls to it's sex chat line customers.

At about 24 minutes into this[33] the Judge questions the attorney of Sprint who explains to the court "there weren't any proper charges (from NCC to Sprint)" and "Because if NCC didn't exist HFT wouldn't exist, and we wouldn't have this traffic pumping and access stimulation, calls to adult chat lines, they just wouldn't have existed" "this business practice is built on a relationship between telephone company (CLEC/NCC) and chat line company (HFT) in which they have to be business partners for this to work. Cuz telephone company bills the long distance company (SPRINT), and they split the profits to fund the venture, and the problem is where you're doing business together you're not a common carrier's customer!"[34] |

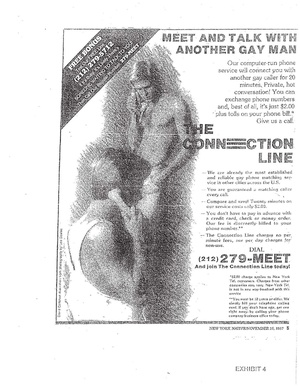

| HFT chat line ad showing local number |

NCC files a complaint with the FCC seeking to make Cricket allow it's customers to call 900 numbers which Cricket doesn't allow for any of it's customers. NCC's complaint is DISMISSED.

United States Supreme Court

| Document | Information/Description |

|---|---|

| Supreme Court of the United States - No 10-257 - North County Communications Corp vs California Catalog and Technology dba CTT Telecomms, Petition for Write of Certiorari. Petition was DENIED.[35] | Petition regarding Case No 08-55048 from the United States Court of Appeals for the Ninth Circuit. Writs of Certiorari[36]: Parties who are not satisfied with the decision of a lower court must petition the U.S. Supreme Court to hear their case.[37] |

Bankruptcy Court

Todd has filed bankruptcy a couple times that can be found in PACER. What is interesting is these were filed pro-se[38], for oneself, on one's own behalf. In both cases the case was dismissed for failure to properly file all the required documents.

Upon review of the records from San Diego County, it was found both these filings aligned with foreclosure proceedings on his residence or business. This is a well known tactic, as a bankruptcy filing will pause all foreclosure actions giving time to the debtor, and encouraging the holder of the loan to settle. In both cases Todd was able to re-mortgage or finance his residence, and then have the court dismiss the case. In the second time in 2019 he entered into a trust agreement with his father loaning him over 1,000,000 dollars.

| Case Number | Filing Date | Status | Discharge Date | Chapter | Disposition | Court |

|---|---|---|---|---|---|---|

| 1903194 | 05/31/2019 | Voluntary | 06/18/2019 | 13 | Dismissed | California Southern - San Diego |

| 1803554 | 06/13/2018 | Voluntary | 06/28/2018 | 13 | Dismissed | California Southern - San Diego |

| Date | Item | Comment |

|---|---|---|

| Feb 22, 2018 | Todd Lesser's residence has a foreclosure notice on it for failure to pay $32,944.76. | Note that Todd still owes Yvonne Smith the $400,000.00 on the property as well. |

| March 23, 2018 | Todd Lesser's residence has the debt paid off to the same bank for $575,000.00. Then he files bankruptcy and Wells Fargo bank requests a special hearing. |

This of course stays any foreclosure action on his home or collection actions against him by other creditors. |

Judgements and Liens

The following judgements and liens were found.

| Filing Date | TMS ID | Jurisdiction | Debtors - Name | Debtors - Address |

|---|---|---|---|---|

| 12/01/2016 | CA00167559272014 | CA | Todd Leonard Lesser | 4008 Taylor St, San Diego, CA 92110 |

| 03/24/2015 | CA00157456254594 | CA | Todd Lesser | 2717 Hidden Valley Rd, La Jolla, CA 92037 |

Additional Liens

The following gives more information on Liens that were found:

| Name | Address | Filing Location | Total Lien Amount | Issuing Agency | Deed Category Type | Damar Document Type | Document Recording Number | Court Case Number | Tax Lien Serial Number | Tax Type | Tax Payer ID | Tax Period Dates | Tax Lien Date | Recording Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Todd Lesser | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | San Diego, CA | $9,410.74 | FRANCHISE TAX BOARD | Placement | State Tax Lien | 217277 | 217227 | 23222602917 | FRANCHISE TAX | 120613256 | Dec 31, 2017 - Dec 31, 2019 | Aug 10, 2023 | Aug 10, 2023 |

Additional Judgements

The following gives a more comprehensive listing of Judgements that were found:

| Debtor Name | Address | Creditor Name | Filing Location | Court Case Number | Total Judgement Amount | Deed Category Type | Damar Document Type | Recording Number | Recording Date | Abstract Issue Date |

|---|---|---|---|---|---|---|---|---|---|---|

| TODD LESSER | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | PAMELA A PHILLIPS | San Diego, CA | 372****83845CUBCCT | $1,788,279.14 | Placement | Abstract of Judgment Modification | 357138 | Sep 8, 2022 | Sep 7, 2022 |

| TODD LESSER | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | - | Riverside, CA | 37-2011****5-CU-B | $504,507.93 | Placement | Judgement | 141583 | Apr 25, 2019 | Apr 4, 2019 |

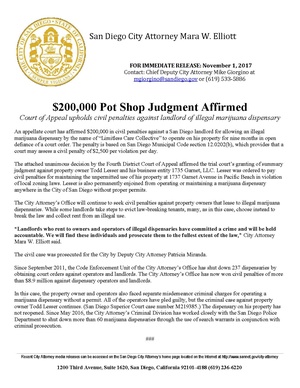

| TODD LESSER | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | CITY OF SAN DIEGO | San Diego, CA | 37-2015****71-CU- | $200,000.00 | Placement | Judgement | 126301 | Mar 29, 2018 | Mar 23, 2018 |

| TODD LESSER | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | BANK OF AMERICA NA | San Diego, CA | 37-2016****42 | $136,727.96 | Placement | Judgement | 444025 | Sep 27, 2017 | Jul 17, 2017 |

| TODD LESSER | 2717 Hidden Valley Rd, La Jolla, CA, 92037 | DISCOVER BANK | San Diego, CA | 37-2016****67-CL- | $6,088.86 | Placement | Judgement | 441050 | Sep 26, 2017 | Aug 15, 2017 |

Sale of Property

On 15 April 2024, Todd Lesser's long time primary residence of 2717 Hidden Valley Rd, La Jolla, CA (SDMLS #230018679) was sold for $2,650,000. The properly was listed on 22 Sept 2023 for the amount of $2,995,000 as 2,528 Sq Ft with 4 bedrooms and 2 bathrooms.

Uniform Commercial Code (UCC) Filings

The following are the Uniform Commercial Code ("UCC")[39] filings that were found.

There are several types of UCCs. The most basic and well known is the UCC-1. Essentially, a UCC-1 can be described as a financing statement. In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor’s personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

UCC filings are better known as liens made against someone's property due to a debt that was incurred.

| Filing Date | Filing Number | Filing Type | State | TMS ID | Debtors - Name | Debtors - Address | Secured Party Info |

|---|---|---|---|---|---|---|---|

| 12/01/2016 | 167559272014 | Judgement Lien | CA | CA167559272014 | Todd Leonard Lesser | 4008 Taylor St, San Diego, CA 92110 | WELLS FARGO BANK, NATIONAL ASSOCIATION - EL MONTE, CA |

| 03/24/2015 | 157456254594 | Judgement Lien | CA | CA00157456254594 | Todd Lesser | 2717 Hidden Valley Rd, La Jolla, CA 92037 | VAYA TELECOM, INC. - EL DORADO HILLS, CA |

| 05/26/2009 | 097197693213 | Financing Statement | CA | CA097197693213 | Todd Leonard Lesser | 4008 Taylor St, San Diego, CA 92110 | WESBANCO BANK, INC. - CHARLESTON, WV |

| 11/19/2004 | 200400595668 | <None Specified> | WV | DNB20040059566820041119 | Todd Lesser | 2717 Hidden Valley Rd, La Jolla, CA 92037 | <Not available> |

| 11/19/2004 | 200400595670 | <None Specified> | WV | DNB20040059567020041119 | Todd Lesser | 2717 Hidden Valley Rd, La Jolla, CA 92037 | <Not available> |

| 08/02/2004 | 0421760552 | Financing Statement | CA | CA0421760552 | Todd Leonard Lesser | 2717 Hidden Valley Rd, La Jolla, CA 92037 | <Not available> |

San Diego County

Our search in San Diego produced the following.

Of the most interesting was his judgements from NCC vs. Vaya Telecom. This case was essentially the same as the federal actions on access stimulation and took years to bring to trial/appeal/final judgement. Now the final judgments are done and the court has held NCC, HFT and Todd personally and jointly liable

The Discovery Referee held that NCC, Todd Lesser, HFT Inc and Jartel, Inc. failed to comply with the courts discovery orders. This wasting of court and attorney time was assigned to Todd personally.[41]

- 2020-06-06 - $597,474.38 judgment against Todd Lesser and his companies.

- 2020-12-02 - $1,357,154.27 judgment against Todd Lesser and his companies.

Other outstanding debts Todd has:

- 2017-04 44025 $136,727.96 - Bank of America judgement

- 2017-04 41050 $6,088.86 - Discover Card Bank

Narcotics Forfeiture

Todd has been sanctioned twice by the City of San Diego for operating an unlicensed narcotics distribution site on his property. This is the same property address he has listed on his FCC Amateur Radio License [42].

4008 Taylor St LLC [43][44] 2018-0126301.pdf - this is the second time around

2017-0214411.pdf - Narcotics forfeiture action against Todd Lesser by city of San Diego

In this case, Todd Lesser was held personally responsible for $200,000.00 dollars for willfully defying a temporary injunction by the court. This was the second such business he allowed to operate at this location involved in illegal narcotics distribution.

Criminal case M234214-06 and M219385-05 are showing with the courts relating to this.

Property Foreclosures

Multiple times in the past 5 years Todd's residence at 2717 Hidden Valley Rd. La Jolla, CA 92037 has gone into for failure to pay the mortgage as agreed.

Todd has previously used his residence in such a fashion with a private note from a Yvonne Smith in April 2018 of $400,000.00 Dollars. 2018-0160972.pdf

In December 2019 Todd has borrowed $1,043,440.00 on this property from his father. This coincided with Todd's bankruptcy and Lis Pendens (suit pending)[45][46] from his mortgage holder. It remains to be seen if he is paying his father as agreed under this trust[47]

Filing False Lis Pendens

In 2006 Todd made an offer to purchase a property from John Raymond, Managing Member of Surfstone, LLC. This offer expired and Todd preceded as if it was signed and agreed too. Todd then filed a lis pendens on the property and the property owner sued to have it revoked by the court.

The court held this was not a proper lis pendens and sanctioned Todd and dismissed the action by him.

Other San Diego Records

West Virginia

Our search in West Virginia produced the following.

- 2020-03-30 - A Motion/Application/Petition for a Default Judgement in the Southern District Court of West Virginia, Charleston Division was made. WesBanco Bank, Inc. filed on November 20, 2019 an instant action for monetary judgement on the outstanding deficiency balance owed on a loan made by WesBanco to Todd Lesser. "On February 18, 2020, the Defendant was properly served in La Jolla, California by substitute service at his primary residence by a private investigator hired by WesBanco, Mr. Gregory Long."[48]

- 2020-03-31 - An order on Motion/Application/Petition for Entry of Default Judgement was issued.[49]

- 2020-04-15 - A Motion/Application/Petition for Default Judgement was filed by WesBanco. It is noted that "On multiple occasions, prior to service, the Defendant evaded WesBanco’s attempts at effectuating service of process on him." The Investigator's Affidavit of Service is included as supporting documentation and details the attempts at effectuating service and Todd Lesser's evasion. (See Investigator's Report below for details).[50]

- 2020-05-22 - An order on the Motion/Application/Petition for Default Judgement was issued.[51]

The Court has reviewed Plaintiff WesBanco Bank Inc.’s Motion for Default Judgment (Document 13)[50] and the attached exhibits, filed on April 15, 2020. The motion and affidavits set forth the amount due and state that the Defendant is not an infant or incompetent.

The Plaintiff served the Defendant, Todd Lesser, by leaving the summons with Andrea Lesser at their residence on February 18, 2020. The investigator used to effectuate service indicates that Mr. Lesser evaded multiple prior attempts at service. No responsive pleading was filed, and the Clerk entered default on March 31, 2020, at the Court’s direction. Both the Court’s order directing entry of default (Document 10) and the Entry of Default by Clerk (Document 11) were sent to the Defendant by certified mail. The Court’s order was returned as undeliverable. A return receipt card for the Clerk’s entry of default indicates that it was left with an individual on April 10, 2020. To date, the Defendant has not filed a response to the lawsuit or the entry of default.

The Plaintiff, WesBanco, alleges that Mr. Lesser applied for and received a loan to finance an office building in Charleston, West Virginia. The loan was secured by the office building. The Plaintiff alleges that it foreclosed, and the payoff balance was $328,954.20 at the time of the foreclosure sale. There was a deficiency balance of $128,756.55 after the property sold for $242,000, less sale expenses of $28,823.51.

In its motion for default judgment, after accounting for interest, WesBanco seeks $136,983.69 for the deficiency balance of the loan, plus legal fees and costs of $5,755.00 and interest accruing at a daily rate of $11.90 from March 31, 2020. The terms of the promissory note, details of the sale, and amount of attorney’s costs and fees are confirmed by the attached exhibits and affidavits.

After careful consideration, the Court finds that the amount of damages, as computed, is a sum certain pursuant to Federal Rule of Civil Procedure 55(b)(1). Accordingly, the Court ORDERS that Plaintiff Wesbanco Bank Inc.’s Motion for Default Judgment (Document 13) be GRANTED and that default judgment be entered against the Defendant, Todd Lesser, in the amount of $142,738.69, plus interest of $11.90 per day accruing from March 31, 2020.

The Court DIRECTS the Clerk to send a certified copy of this Order to counsel of record and to any unrepresented party.

Investigator's Report

The following notable items were taken from the investigator's Affadavit of Service when attempting to locate and personally serve Todd Lesser on behalf of WesBanco Bank, Inc. [52]

- I attempted to locate and serve the Defendant at the office space owned by him located at 4008 Taylor Street #201, San Diego, CA 92110. However, the office space was all locked up with no tenants.

- After investigating the various properties owned by the Defendant, I determined that the best opportunity for a successful service of process was at the Defendant's home residence located at 2717 Hidden Valley Road, La Jolla, California 92037-4028 (the "Residence").

- I visited the Residence on multiple occasions and attempted to service by knocking on the front door. Although I could hear noise coming from the Residence, nobody ever came to answer my knocking other than the Defendant's dog.

- On Sunday, January 13, 2020, I was parked at the end of the Defendant's driveway and observed who I believed to be the Defendant's spouse taking the trash out. She is a white female with long blond hair, in her mid-thirties, an a height and weight of approximately five feet six and one hundred thirty-five pounds. I exited my vehicle and attempted to serve her. However, as soon as she noticed me, she quickly made her way back up the driveway to the Residence. By the time I reached the top of the Defendant's driveway she was already back inside the Residence and nobody answered my subsequent knocking on the front door.

- On Sunday, February 9, 2020, I conducted a stakeout in hopes that I would effectuate service on the Defendant or his spouse while they took the trash out. My stakeout was unsuccessful as I saw neither the Defendant nor his spouse.

- I returned to the Residence the following morning, Monday, February 10, 2020. At approximately 7:55 a.m., a grey BMW departed from the Defendant's driveway. I followed the BMW in my vehicle, the BMW sped away and deliberately took a detour to disallow me to meet it in a crowded intersection where I could jump out of my vehicle and place the service paper's on the BMW's windshield.

- Following this unsuccessful attempt, I ran the BMW's license plate and confirmed that the vehicle was registered to the Defendant' spouse, Andrea Lesser.

- On Tuesday, February 18, 2020, I arrived at the Residence for another stakeout. At approximately 6:30 a.m. I parked my vehicle a safe distance away from the Residence to avoid detection. I exited my vehicle and walked to the end of the Defendant's driveway and sat on a chair and waited for any sign of the Defendant or his spouse.

- At approximately 8:01 a.m., the Defendant's spouse drove down the driveway in her vehicle. I verbally informed her that she'd been served as soon as she drove by. A photograph of the Defendant's spouse's vehicle driving past me at 8:01 a.m. on February 18, 2022 is attached as Exhibit A.

- I then proceeded up the Defendant's driveway and left a copy of the Complaint and Summons at the Residence's front door. A photograph of the service papers as I left from on the Residence's front door is attached as Exhibit B.

- Prior to successfully serving the Complaint upon the Defendant's spouse, the Defendant and/or spouse evaded my attempts at service on multiple occasions.

New York

Our search in New York produced the following.

In 2002, NCC filed suit against Verizon New York (VNY), Verizon Services Corporation (Verizon), and what is listed as DOES 1 through 100. The suit was originally brought by NCC in New York State court. Verizon filed a notice to remove the action to federal district court, and NCC moved to remand it back to state court. The following are excepts from United States District Court, Northern District New York Case 1:02-cv-01065-DNH-RFT, MEMORANDUM-DECISION and ORDER[53] regarding the case and both parties actions.

NCC alleged in their complaint:

- On March 14, 2001, NCC as a CLEC, notified Verizon of its intent to interconnect with Verizon networks in New York State. VNY is an ILEC. NCC claims that in the six months following, Verizon "deliberately dragged [its] feet and put up obstacles and roadblocks to keep [North County] out of the local telecommunications market in New York, all for the purpose of maintaining [VNY's] grip on the local telephone market, depriving consumers maximum choice with their telecommunications dollars and damaging [North County] in the process"

- NCC claimed that the Verizon account manager assigned "stonewall[ed] the interconnection process by making unreasonable, onerous and unnecessary demands upon [North County]".

- Among the demands made was the alleged interconnection prerequisite that a "dedicated" facility be built. NCC contends that VNY, as in ILEC, controls facilities throughout the New York telecommunications market, stating that he funding necessary to build these facilities was provided in part by VNY's ratepayers and those of it predecessors, New York Telephone and Bell Atlantic.

- NCC was unable to procure funding for the construction of new facilities, and instead requested interconnection at two separate Verizon facilities in New York. NCC claimed that Verizon refused the request, despite the technical capabilities to grant it, and despite allowing other affiliates or parties to share the facilities. Instead Verizon restated the requirements to build new facilities and refused to hold further meetings with NCC until the construction of the new facilities was complete.

- NCC stated that Verizon acted in a way to continue maintaining "monopolistic power over the New York City telecommunications market" including:

- repeatedly lost orders and signature pages

- ignored [North County's] request to opt into an exiting interconnections [sic] agreement between [VNY] and another CLEC; as was North County's right

- insisted on installing equipment on unnecessary additional racks at the location where [North County] was subleasing space, despite the absence of any technical reason to impose such a requirement, and needlessly raising the cost of doing business for [North County]

- refused to allow [North County] to order interconnection trunks, thus preventing [North County] from being able to order prefixes

- refused to build trunks in as timely a fashion as with other service offerings, and as if [North County] were a retail customer

- demanded that [North County] provide the defendants with information which [North County] was unable to provide because the information resided in the defendants' sole possession, and then delayed the interconnection process further when [North County] was unable to provide the information demanded

- demanded that information which [North County] had already submitted to be resubmitted in a different format

- failed to treat [North County] as well as if [it] were a [VNY] retail customer or an affiliate of the defendants; and

- refused to use a shared mux for wholesale services, despite the technical feasibility of doing so

Additionally, NCC claimed that Verizon engaged in anti-competitive and monopolistic activities in violation of the Donnelly Act, N.Y. Gen Bus L § 340[54]. And NCC claimed that Verizon had a duty, under Article 5, Section 91 of the New York Public Service Law, "to provide and furnish instrumentalities and facilities that were adequate, just and reasonable, and to refrain from making unreasonable or unjust charges for services rendered." NCC also claimed that Verizon was making charges and demands that were greater than those made of other similar corporations, and that "Verizon subjected North County unreasonable prejudice or disadvantage".

The District Court ruled that Verizon's motion to move the case from state to federal court was unwarranted under existing case law, and that "North County's Complaint is Well-Pleaded" with regards to keeping the case in state jurisdiction. The District Court ruled:

The plaintiff's well-pleaded complaint alleges only state law claims. Such claims are neither artfully pleaded or completely preempted by federal law. The interconnection agreement itself, if in fact it does control, does not mandate that federal claims be asserted in federal court. No subject matter jurisdiction exists. This case must be remanded to the Supreme Court of New York. Accordingly, it is ORDERED that: 1. Plaintiff North County Communications Corporation's motion to remanded is GRANTED; and 2. The case is remanded back to the Supreme Court of New York, County of Albany."

The Supreme Court of New York, County of Albany reviewed the case and granted the defendant's motion that it be moved from Albany County to New York County (Manhattan).

The Supreme Court of New York, New York County reviewed the case (401925-03)[55], the court examined the claims from both sides, and ruled that:

- NCC's allegations under the Donnelly Act and Public service Law, both State claims, are independent of any interconnection agreement, and that NCC's complaint is regarding Verizon's conduct.

- NCC's claim under the Donnelly Act: "the complaint does not allege concerted action in support of a conspiracy, or a reciprocal relationship between two or more entities. Rather, NCC's allegations are directed towards Verizon's alleged unilateral actions and delay tactics. The failure to identify a coconspirator cannot be remedied 'by asserting, in conclusory fashion, the existence of a generalized conspiracy arising our of defendants' various contracts and arrangements or by referring to uniliateral business action taken by them' and NCC's failure 'to allege that the defendant engaged in concerted activity requires dismissal'". The court also stated that "sister subsidiary corporations which are wholly owned by the same parent corporation are legally incapable of conspiring with each other". It was also noted that NCC's failure to state the names of the "numerous Doe defendants" led to the dismissal of the Donnelly Act claim for lack of sufficient evidence.

- NCC's Public Service Law claim, mainly that "sections 91 and 93 of the Public Service law should be interpreted broadly" was dismissed.

Accordingly, it is hereby ORDERED that the motion to dismiss is granted and the complaint is dismissed, without prejudice as indicated, with costs and disbursements to defendant as taxed by the Clerk of the Court; and it is further ORDERED that the Clerk is directed to enter judgement accordingly.

Local Politics

Todd seems to desire involvement in the politics of his city in any form. He's served and resigned from a couple minor city boards with limited powers. In several cases he's protested the election or findings of the board when such actions have gone against his positions or interests.

La Jolla

La Jolla Traffic and Transportation Board

La Jolla Community Planning Association[56]

La Jolla Traffic & Transportation Board (T&T) T&T considers all proposals affecting La Jolla’s streets (striping, stop signs, traffic calming) and parking (curb colors, time limits, valet). Also hears special events that require traffic control or affect on-street parking. Recommendations are forwarded to the LJCPA for ratification and then sent to the City of San Diego for implementation. The Board is comprised of two appointed members each from the LJCPA, the La Jolla Town Council, the La Jolla Shores Association, La Jolla Village Merchants Association, and the Bird Rock Community Council. Meetings are always open to the public and are held on the 3rd Wednesday of every month, at 4:00 p.m. at the La Jolla Recreation Center, 615 Prospect Street.

| Title | Link | Description |

|---|---|---|

| La Jolla Town Council Inaugural La Jolla State of Address | https://www.youtube.com/watch?v=pnmO2oYJYaM | Todd Lesser, President of the La Jolla Traffic and Transportation Board |

La Jolla Shores Association

La Jolla Shores Association ("LJSA")[57]

One of the most popular destinations in Southern California, La Jolla Shores has an effective and active citizen based forum for matters concerning the community and area of La Jolla Shores. For almost 60 years, the La Jolla Shores Association (LJSA) has been guiding, advising and leading the discussions with the San Diego City Council, Parks and Recreation, UCSD and other governmental agencies concerning quality of life issues year round.

| Title | Link | Description |

|---|---|---|

| Tempera Flare over officer election At La Jolla Shores Association | http://www.sdnews.com/view/full_story/22368481/article-Tempers-flare-over-officer-election-at-LJSA[58] | La Jolla Shores Association (LJSA) held a special meeting ahead of its regular monthly meeting May 13, to answer questions about how its March election was conducted |

| San Diego, La Jolla Shores Association Address Election Challenge | https://www.lajollalight.com/sdljl-shores-association-address-election-challenge-2015-2015may21-story.html[1] | Todd argues over flipping a coin. His attorney makes a case that a strict following of Roberts Rules of Order is Required. |

Final Thoughts

Our research only covered one county in California. It's not unreasonable to assume other counties may have other such actions in their court systems, especially in places Todd Lesser has conducted his businesses.

From the above it would appear Todd Lesser's choice of professions have been based mostly on less than ethical choices and that has been catching up with him. Having worked with him in the past I know he loves to talk until he is able to get his way. It takes a strong person to stand up and say "No" to him.

As we have added up over $2,500,000 (2.5 million) dollars in debts he is personally liable for, and his pattern of being less than truthful under oath one must question what was wrong with the prior AllStarLink Board of Directors in letting him direct most of the corporation. AllStarLink now is in a position of operating in debt and one can envision Todd Lesser wanting to run it in the manner he's run his other businesses.

July 2022 Update

Since the original search and publication of this information regarding Todd Lesser, more information of his financial difficulties have come to light. Todd Lesser was awarded a default judgement in West Virginia, and information regarding this has been added to this page. This wiki will continue to be updated as more information on Todd Lesser and his businesses come to light.

March 2023 Update

On 28 March 2023, as part of the ongoing litigation between Pacific Bell Telephone Company d/b/a AT&T California and Vaya Telecom, Inc., a motion was made by Vaya Telecom as follows [59]:

Pursuant to Rule 9.4 of the Commission’s Rules of Practice and Procedure, Vaya Telecom, Inc. (“Vaya”) (U-7122-C) hereby moves the Commission for disqualification of Administrative Law Judge Kline for cause in the above captioned proceeding. This Motion is necessitated due to repeated ex parte communications directed to Judge Kline from a non-party on the sole substantive issue in the proceeding. Namely, Mr. Todd Lesser has repeatedly contacted Judge Kline on an ex parte basis making baseless accusations against Vaya, and specifically alleging that Vaya operates in an integrated fashion with a sister entity, O1 Communications, Inc. (“O1”) generally, and specifically to evade legal obligations.

The sole issue being litigated in the pending Order to Show Cause (“OSC”) is whether Vaya and O1 operate in an integrated fashion sufficient to warrant requiring O1 to pay an award Vaya has been directed to pay the plaintiff, Pacific Bell Telephone Company d/b/a/ AT&T California. Hearings were completed in December 2021 and briefing in the OSC proceeding was completed in January 2022. The parties are therefore awaiting the issuance of the Presiding Officer’s Decision (“POD”).

While the improper ex parte communications are the fault of Mr. Lesser, Judge Kline has nonetheless been exposed to multiple defamatory and unsubstantiated assertions regarding the exact issues in the OSC proceeding. Judge Kline cannot un-hear what Mr. Lesser has said, and that damage cannot be undone. Especially at this critical time as Judge Kline is drafting the POD, there is a very real chance that Judge Kline may have been influenced by Mr. Lesser’s extra-record and false claims despite her best efforts to disregard them. Indeed, Judge Kline responded to one of Mr. Lesser’s ex parte emails by stating that he would need to file a motion for party status if he wants to provide information in this proceeding. Thus Mr. Lesser’s communications have created a real and concrete concern that Judge Kline is taking into account Mr. Lesser’s wild accusations and may be unable to render a decision based only on record evidence. Vaya reluctantly has concluded that it must move for reassignment of the remainder of this proceeding to another judge to ensure a fair and unbiased decision.

- 2023-03-08: Todd Lesser emails Assistant Chief Administrative Law Judge Zita Kline of the California Public Utilities Commission. As part of the items sent to Judge Kline, Todd Lesser included a previous email chain showing that on 26 August 2022, he attempted to offer a $50k settlement to Vaya Telecom instead of paying the (then) $1.8 million that was owed. Vaya Telecom declined this settlement offer.